As seen on:

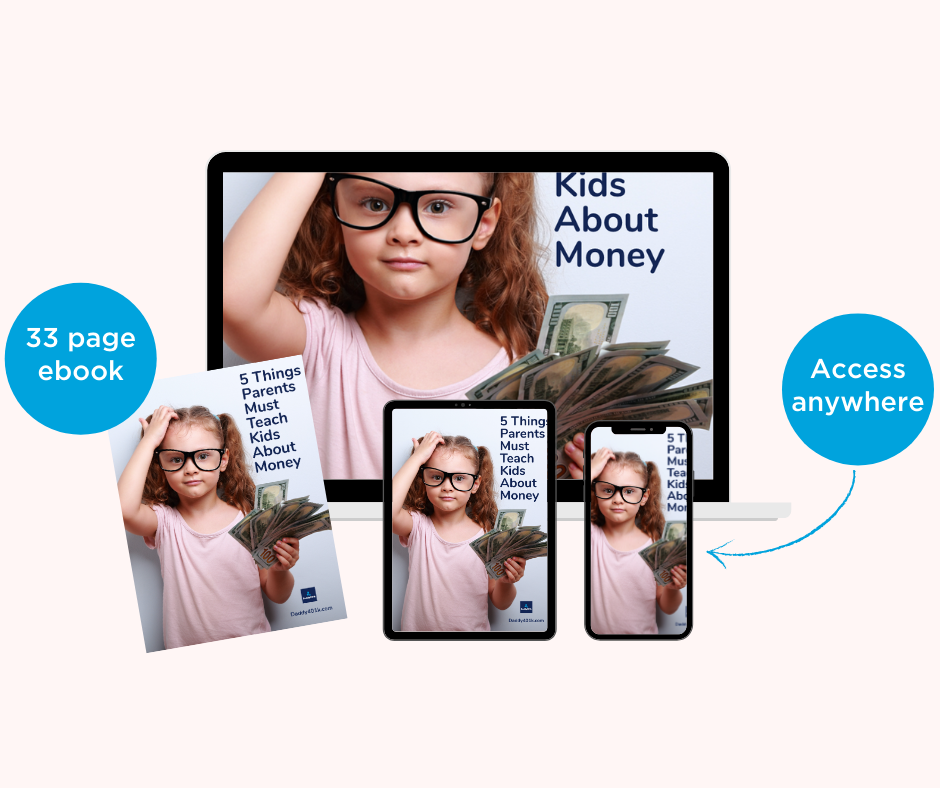

This is the solution for how to help your kids form good habits now for managing money wisely, avoiding debt, and investing early for their financial freedom.

Worried that your kids won’t be taught financial literacy at school?

Concerned that they will end up living paycheck to paycheck and in debt just like 75% of workers in the U.S. today?

Wondering if they will ever be able to handle their finances well and avoid the pain and stress of money problems?

Troubled that your kids will be able to retire someday without learning how to invest?

This is the same personal finance coaching my wife and I gave our daughters. The result was two young women who are college graduates, employed, and debt free. They are now living as young adults on a budget with an emergency fund. They’re also already investing in their retirements.

You’ll learn how to teach them financial literacy for kids. Learning these skills will put them on the right track to be good with money as adults and to become millionaires by age 51.

If you’re giving your kids an allowance, then you’re making a big mistake.

Encourage kids to be thoughtful about purchasing decisions when they are being tempted by an impulse buy.

Having a good attitude about money management and talking with your kids about purchases using logic and comparisons are two ways to set a good example about personal finance.

Kids learn to budget using 3 envelopes.

Provide your kids a head start and help them to achieve financial freedom and become millionaires in their 50s.

“This resource was just what I needed. If parents don’t teach kids how to handle money wisely, then they will probably have financial problems as adults.”

-Ellen, Kentucky

I’ve been a financial coach of some sort for over 20 years. I have a passion for financial literacy for kids. I especially like to share how my wife and I raised our two daughters. We gave them a head start for financial freedom that we didn’t have when we ventured out into the world as young adults.

I’m probably a lot like you. I‘ve made plenty of mistakes with my finances and I don’t want my kids to have to go through that kind of pain. They won’t learn about personal finance in school, so it’s up to us! I’ve invested a lot of time, money, deep thought, and trial and error to improve my financial coaching skills.

Along the way I earned two important credentials:

I’ve been sharing these lessons with friends and family for over 15 years and they’ve seen great results with their kids too.

No, it works for moms, grandparents, aunts, uncles, or anyone else who wants to provide young people with a head start for financial freedom.

No. I don’t sell any financial products. This ebook tells the story, reveals the details, and gives examples of the financial coaching my wife and I gave our daughters.

These 5 things apply to adults as well. You can implement the lessons for yourself while you teach your kids and also improve your money management skills.

The 5 things are basic fundamental personal finance skills. They’re not complex but they do require commitment and self-discipline to implement.

As soon as kids become aware of money – it’s time to start. But it’s never too late. These lessons can improve the personal finance skills of grade school children, teens, and even adults.

“This ebook is much needed. The lessons are simple, and they work! My kids are earning their own money and budgeting. They will be ready and confident with their finances when they enter the adult world.”

-Jill, Texas